Essex Property Trust

As the sole general partner of EPLP, Essex has a control of EPLP's everyday administration. The Company is organized as an umbrella association REIT ("UPREIT"), and Essex contributes to every net starting from its different value offerings and finishing with the operating partnership. Consequently, for its commitments, Essex gets various OP units equivalent to the quantity of shares of the basic stock it has issued in the value advertising. Commitments of properties to the Company can be organized as duty conceded exchanges through the issuance of OP units in the Operating Partnership, which is a reason why the Company is organized in the way described above. In light of the terms of EPLP's organization assertion, OP units can be traded with Essex average stock on a one-for-one premise.

JP Morgan Investment Funds

Part I of the Luxembourg Law of 17 December 2010 identified aggregate venture endeavors and qualified them as an Undertaking for Collective Investments in Transferable Securities ("UCITS") under the EC Directive 2009/65 of 13 July 2009.Thus, they might be offered to be purchased in European Union ("EU") member states (subject to enlistment in nations other than Luxembourg). Also, applications to enlist the fund may be made in different nations. None of the shares have been or will be enlisted under the United States Securities Act of 1933 (the "1933 Act") or under the securities laws of any state or political subdivision of the United States of America or any of its domains belonging to different regions subject to its authority including the Commonwealth of Puerto Rico.

Performance Reporting Standards

Essex Property Trust

Changes in the framework of building the U.S. accounting principles might substantially and antagonistically influence its reported consequences of operations. Representing open organizations in the United States has verifiably been directed as per proper accounting (GAAP). GAAP is developed by the Financial Accounting Standards Board (FASB), an autonomous body whose benchmarks are perceived by the SEC as definitive for openly held organizations. The International Accounting Standards Board (IASB) is a London-based free board established in 2001 and known for the improvement of International Financial Reporting Standards (IFRS). IFRS, for the most part, reflects accounting practices that dominate in Europe and other countries around the globe.

The organization monitors the SEC's movement concerning the proposed selection of IFRS by the United States’ public agencies. It is not clear now how the SEC will suggest adjusting GAAP and IFRS if the proposed change is embraced. Furthermore, applying another technique for accounting and adopting IFRS would be a mind-boggling undertaking. The organization would conceivably need to grow new frameworks and controls taking into account the standards of IFRS. Since these are new attempts, and the exact prerequisites of the affirmations, at last, to be received are not currently known, the extent of expenses connected with this change is questionable. Until there is more conviction as for the IFRS principles that could be received, financial specialists ought to consider that its transformation to IFRS could have a material antagonistic effect on the reported consequences of operations.

JP Morgan

Notwithstanding investigating the firm's outcomes on a reported premise, the administration audits the firm's outcomes and the aftereffects of the lines of business on a "management" premise, which is a non-GAAP monetary measure. GAAP comes about and incorporates certain renamed arrangements to present aggregate net income for the firm on a completely assessable proportional (FTE) premise. As it should be, income from ventures that get duty credits and cost excluded securities is introduced in the management results on a premise practically identical to the assessable investments and securities. This non-GAAP financial measure permits the administration to evaluate the similarity of income emerging from both assessable and duty absolved sources. The comparing pay assessment effect identified with duty excluded things is recorded inside the expense pay cost. These changes have no effect on net pay as reported by the firm in general or by the lines of business.

Substantial average value (TCE), return on unmistakable regular value (ROTCE), and distinct book value per offer (TBVPS) are each non-GAAP financial measures. TCE speaks to the firm's average stockholders' value less goodwill and identifiable immaterial resources, net of related conceded charge liabilities. ROTCE measures the firm's profit as a rate of average TCE. TBVPS addresses the firm's TCE at period-end separated by average shares at period-end. TCE, ROTCE, and TBVPS are significant to the firm and financial specialists and examiners, in surveying the firm's utilization of value.

Global Investment Performance Standards (GIPS)

Essex Property Trust

The Global Real Estate Securities composite incorporates portfolios that regularly put resources into REITs and organizations occupied with the land business internationally. New records meeting Composite criteria are integrated into the Composite according to the Composite's Grace Period Policy. The Composite's Grace Period Policy requires account consideration following record initiation in the (1) first entire month following origin when beginning happens on the fifteenth or earlier of a given month.

From September 1, 2014, Composite policy requires the formation of a makeshift record for an individual customer initiated cash and security flow. The temporary account is made to hold incidentally cash or securities until contributed according to the Composite procedure or pulled back by the customer. All exchanges are executed in the principle account. Preceding September 1, 2014, Composite strategies did exclude the utilization of interim records or characterize Significant Cash Flows. Extra data on the treatment of Significant Cash Flows is accessible upon solicitation.

Returns are aggregate, time-weighted rates of return reported in U.S. dollars and incorporated collected wage. The Composite and Benchmark results mirror the reinvestment of profits and different income. Portfolios are esteemed on an exchange date premise. Month to month execution is computed by connecting day by day returns. The Composite return is an advantage weighted normal of the execution consequences of the considerable number of portfolios in the Composite because of the start of month qualities. Composite scattering is not introduced for periods with 5 or fewer portfolios. The 3-year annualized ex-post standard deviation measures the variability of the Composite and the Benchmark returns over the preceding 36-month period and is not introduced for execution times of under 36 months. An adjustment was made to the 2009 net of expense return, diminishing the performance from 76.33% to 76.21%.

JP Morgan

The Emerging Market High Yield Fixed Income Composite incorporates all institutional and retail portfolios put resources into high return obligation securities issued by nations outside the OECD. The methodology takes into consideration interest in foreign currency denominated assets over which the manager has full prudence on supporting. The system expects to convey an aggregate return principally through wage yet with some capital development. High return bonds express expanded levels of credit and default hazard and are less fluid than government and speculation evaluation bonds. Interest in less controlled markets conveys expanded political, monetary and backer danger. The benchmark is the J.P. Morgan Emerging Market Bond Index (EMBI+).

The U.K. Liquidity Plus Composite incorporates every institutional portfolio put resources into a broad scope of short-dated enthusiasm bearing stores, cash counterparts, short business paper, and other currency market speculations issued by major U.K. clearing banks and loaning establishments. The procedure has a focused on changed length of time of less than one year. The central venture goals are safeguarding of capital, upkeep of liquidity, and procurement of yield more prominent than that accessible for the benchmark, the three-month LIBOR rate. The U.K. Liquidity Plus technique varies from more ordinary trade procedures out that it moreover holds short-term business paper, which has a more outstanding presentation to credit risk.

Behavioral Analysis

Essex Property Trust

At the point when the yield of REITs surpasses the yield on the 10-Year Treasury note, it can be a decent time to acquire them. These days, there is no edge of security in REITs. There is a greater than average spread of 3% or so 12-month yield of the Vanguard Real Estate Index Fund and 1.7% yield on the 10-year Treasury. In any case, yield spreads matter more when the yield of the Treasury is not misleadingly stifled by the Fed.

The reality that REITs are showing minimum returns in absolute terms mirrors the accomplishment of the Fed in making investors resort to more risky resources. This may not keep going forever as the 10-Year Treasury yield has been increasing from a previous 1.4% base. If the Treasury yield gets into the 2% territory, will financial specialists be loaded with the danger of owning profoundly levered REITs for 3%? Probably, the increase in rates on the 10-year into 2% territory will begin to perpetrate torment on REITs. Maybe, the yield on the 10-Year Treasury will stay beneath 2% for quite a while, yet a person is playing with flame and not contributing to an edge of wellbeing in case he/she relies on that.

REITs are possession units of the organizations, which mean that the company can profit by expansion as property owners raise their rents. However, the company additionally accompanies the dangers of proprietorship and the potential prizes. In this situation, it is worth discussing exceedingly utilized monetary records: an REIT is not a secured Treasury bond. Even this ruddy measure of income makes REITs look extravagant, which is fairly startling. Looking at the leading 20 organizations of the Vanguard REIT Index Fund VGSIX, - 0.77%, which tracks the MSCI U.S. REIT Index; also, it was found that the average Price/FFO of these organizations is around 22. That is high. At the end of the day, one is paying $22 for each dollar of income that has not yet been docked for upkeep capital consumptions.

JP Morgan

Hybrid quantitative and subjective value methodologies can give an advantage by comprehending nonsensical conduct and maintain a strategic distance from oversights established in irrational behavior. On top of that, these systems can abuse opportunities by applying screens and models in light of candidly determined conduct. J.P. Morgan Fund Management's U.S. Behavioral Finance Group uses quantitative models to test substantial investment and rapidly rank stocks in light of certain criteria. At that point, a group of subjective exploration experts deciphers and assesses these rankings applying extra experiences that the quantitative models won't have captured.

Integration of Psychology of Behavioral Finance: Essex and JP Morgan

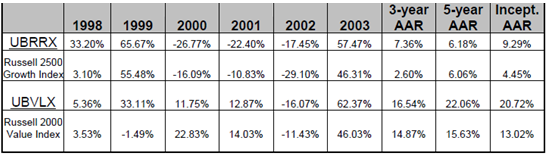

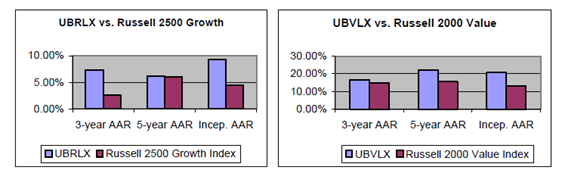

Essex utilizes the Russell 2000 Index as a benchmark for the Behavioral Value Fund and uses the Russell 2500 Growth Index for the Behavioral Growth Fund. As indicated in the plan, the Growth Fund has beaten its benchmark five out of the most recent six years and has had returns that are 4.74% higher. The Value Fund has beaten its benchmark four out of the most recent six years and has had returns that are 7.7% higher. The two common funds appear as though they provide an unrivaled performance at the first look.

The charts compare about three and five-year average returns of Essex Property Trust common funds to its benchmark Russell 2500 Development Index and Russell 2000 value Index. UBRRX is the development store. UBLVX is the value fund.

The Value Fund has a Beta of 1.13, which makes the stock respectably unsafe. Be that as it may, the Russell 2000 quality record just has a Beta of .83. Generally, this record is more secure than the business sector. One should not anticipate that these funds will provide the same returns implying that contrasting them may not yield valuable information.

At the point when choosing whether to put resources into either the Undiscovered Manager's Growth Fund or the According to the Behavioral Growth Fund Prospectus, its financial specialist shares have had an average yearly aggregate return of 6.41% since 1998. JP Morgan Chase, which is contracted to work and market the fund, must top net costs at 1.65%. According to their assessments, this implies that an investor will pay an aggregate of $2,109 in working costs with a beginning venture of $10,000 throughout the following ten years expecting 5% development. This is a note value sum, yet inside of the scope of other little top funds. Presently, JP Morgan is engrossing a .17% charge waiver and cost repayment. Now, a .17% charge waiver and cost repayment that JP Morgan is retaining can be gone along with clients with the chance that yearly costs may ascend to 1.82%.

The Behavioral Value Fund has had an average return of 19.20% since its initiation in 1999. It has a proportion cost top of 1.40%. The company is not charging it now, but can do that in case of the need. JP Morgan is also conceding 35% of costs until 2007, yet could bring aggregate costs up to 2.1%. Since this fund has indicated solid benefits, charging additional expenses may not dissuade venture. If profits do drop, in any case, this could make some real progress on returns. F&T have presumably set low tops genuinely on both of these funds with a specific end goal to engage financial specialists to the funds since the company is new. The company may raise cost expenses further as more cash is put in the funds.

Blue-Essex Property Trust Red-JP Morgan

Ethics in Financial Decision Making

Essex Property Trust

No worker or executive of the Company may share the Company's securities if he or she has access to the pertinent data concerning the Company, which has not been scattered to the contributing open. All in all, this will require such persons to sit tight for no less than forty-eight hours after public return of the data by the Company. The Company additionally has a different exchanging window approach that applies to executives and certain officers of the Company.

The Company has exclusive expectations as for financial feedback to its shareholders and different clients of its financial and open proclamations. Each worker has an obligation to stick to these norms. The Company supports the reporting of data on any suspected case in terms of accounting, false articulations, securities extortion, or other inappropriate behavior of the Company’s representatives. The Company will explore all reports of the suspected securities extortion uncalled for accounting or other related offense and will carry out the private examination and appropriate analysis. If case any extortion, accounting indecency or unfortunate behavior is detected, the Company will make the suitable restorative move which may incorporate, in addition to other things, disciplinary activity against the representatives included.

JP Morgan

JPMorgan Chase issued a corporate administration archive called "How the Organization Does Business." Approved by CEO Jamie Dimon, it is the reaction to the shareholders’ solicitation concerning $26 billion of fines, settlements, and legal expenses that JPMorgan had to pay for its wrongdoing. The carefully composed explanation includes about the issues related to ethics, qualities, and gauges. What is the most essential at JPMorgan is boosting shareholder value as reflected in the stock value or what Jack Welch has called “the most stupid thought on the earth”. The determined quest for shareholder value as measured by the stock cost has prompted the inverse result. An essential spotlight on expanding the stock cost has deliberately crushed value for both shareholders and society.

Use of Data and Information Technology to Bridge the Gap between Abstract Financial Constructs and Managerial Practice

Essex Property Trust

Integrating marketing, application, and installment capacities on one stage makes it simple for the organization to associate with industry accomplices who produce credit reports and distinguish movement sources among different dimensions. Trying to amplify its property and facilitate administration framework, Essex is trying a new gateway, rent check filtering, and mechanized paperless receipt preparing items that will coordinate with the property administration framework. Integration means 100 percent affirmation that the majority of the key data about its 130 properties is present and right, which is not conceivable with interfaces. At the point when the organization utilized interfaces to its property administration framework, its weekly measurements took eight hours to accumulate. If there was an error, it took up to one week to correct it. Presently, the effective coordination of business forms enables the clients to simply click a button to make the reports.

JP Morgan

Financial stability is a worldwide, yet feasible issue that requires more than simply enhancing financial learning. It requires matching pertinent significant data with the item that appeals to people. That is the reason why the organization propelled the Financial Solutions Lab, a $30 million five-year activity management by the Center for Financial Services Technology (CFSI) to distinguish, test, and extend the accessibility of promising developments that can offer Americans some assistance with increasing funds, enhancing credit, and assembling resources.

Conclusion

Essex Property Trust assesses the effect of the appropriation of IFRS on its financial position and consequences of operations. Such assessment cannot be ended without more clarity in regards to the particular IFRS guidelines that would conceivably be received. At JP Morgan, the hybrid process starts with three elements that can be used to rank stocks: value, force, and quality. For instance, energy applies the herd behavior and anchoring conduct, while quality takes data from the overconfidence and regency effect screens that show mispricing. Accounting is regularly alluded to as "the dialect of business" in light of its part in handling financial data that business substances require for overseeing and reporting issues. Shareholders strongly protest when accounting data do not meet their expectations. Consistency, unwavering quality, obviousness, equivalence, and objectivity are acutely sought after measurements of accounting data.